How Quadratic Equations Might Save The World

![]()

With the rapid growth of new energy technologies, and China’s sudden pivot from coal, the solution to the world’s long-term energy issues comes in to plain view. We just need to use a little maths.

2200

By 2100 (for those of you who have children or relatives under the age of 4, they will on average still be alive), central UN forecasts predict a human population of about 10 billion, with 85% in urban environments.

Our thermal fossil fuel system, by definition, cannot be our primary energy source at that time.

As we’ll see, the evidence shows it is already straining and stressed, and falling short of fundamental global requirements such as accessibility, reliability and sustainability:

- 1 billion people or 15% of those on the planet still have no access to modern energy (or ever had it)

- the main energy system, 85% of total world energy, is still based on burning ready-to-hand carbon fuels – this causes major externalities such as a disrupted climate, and as only 5% of the world’s countries actually export fossil fuels it is a manipulated market forcing net consumer nations (the other 95%) to accept structurally high prices and constantly recurring price spikes

- Most fundamentally of all, assuming we wish to still be a modern energy civilization in 2200, (the same time distance from the start of the world-wide industrial age until now, thus a pretty low bar) how do we intend to energise ourselves when the fossil fuels to hand are finite, concentrated and declining?

Fossil fuel longevity is measured often as the Reserves to Production ratio (R/P)- simply the total accessible reserves divided by current production rates.

The world coal R/P ratio is about 130 years – and has grown recently because global production rates have dropped – even in China. Coal consumption has peaked world-wide as most economies drop the fuel.

Oil and gas is a different story: even with extreme engineering efforts and growing annual capital expenditures of $500-750bn pa to access remaining reserves, the R/P ratio has dropped to under 52 years, and has deteriorated by six months every year over the past decade.

For those that suggest the 50-year horizon is an equilibrium, able to be sustained albeit at vast costs, that simple average today masks a much more problematic truth: most international oil companies operate with less than 15 years of reserves left to produce: Exxon has 14, Shell has 9.

The 50 year average is supported mostly by the vast reserves of the Middle East national oil companies in Saudi Arabia, Iran and Iraq plus those in Russia – with all the dangers such a concentration of state-managed supply creates.

At this rate, there will be few environmental, economic, political or even physically viable reserves at all by the turn of the century, when today’s infant, expecting to have all the energy advantages (and more) she was born into, is in her dotage.

1.5

Since 1850 when the modern industrial age emerged globally , humanity’s growth has required vast amounts of energy to provide uninterrupted access to economic heat, power and transport.

The issue now is how does this energy system quickly evolve to meet the global mismatch in energy requirements: growing population, urbanization, climate disorder, a billion still without energy access and a fossil fuel system already declining and dysfunctionally distributed?

The UN labels the problem Sustainable Global Urbanisation, and the IPCC world climate change organisation labels it an existential challenge to the planet if we breach the 1.5-2°C net global temperature increase from 1850 – which is where we are headed.

The prevailing and popular view, even amongst concerned supporters of alternative energy, is a dystopian, resigned, even cynical one.

It takes a look at this triptych of historic population, energy growth and CO2 emissions, marries it to the IPCC latest findings and assumes, since all are on an exponential increase, we cannot hope to find ways to provide solutions to quickly solve the emerging energy crises.

Except by resorting to exotic technical solutions, or near-instant world-wide environmental and policy discipline.

Historic Global Population, Energy and CO2 Emissions Growth, source Ourworldindata.org

This all elicits a curious resigned fury from many anxious commentators – take the FT’s venerable Martin Wolf noting here how the scale and complexity of the problem is vast requiring instant global collaboration; then concluding “the chances of co-operative action seem near-zero in today’s nationalistic world.”

Complementing this is the orthodoxy of high-profile energy analysts such as Vaclav Smil, Daniel Yergin and others who opine that energy transitions are inherently gradual – thus the impact of the current dominant fossil fuel system is here to stay for generations, no matter how hard we try to alleviate it (note Yergin dismissing in 2015 the target of 20% US electricity from wind/solar by 2030 – it is 10% today, about 7 years ahead of that schedule).

Enough, enough and enough.

To all these counsels of despair – bunk.

The key message is this: we have the solution to fossil fuel limitations in front of us, in plain sight, if we have but the resolution to deploy it.

Wind, solar, and large battery technologies – manufactured industrial-scale energy systems – can now be the primary form of energy for the long-term.

If we take the 350 year view from 1850 – 2200, we are only in the first half of the modern energy era – perhaps only the first 20% if we allow for the planet to energise into the next millennia.

The basic units of energy are juvenile in historical terms with the SI standard unit, the joule, only agreed upon at the start the 20th century.

All of this is to say that in the grand turn of human history, the current thermal energy system, for all its seeming heft and permanence, is youthful and still undergoing development.

It’s seems hugely premature to declare it as settled fact that “energy transitions take a long time”.

We can’t know that yet.

We live in, and grew up in, this thermal energy era – but that is no guide to its durability: only us falling for the availability heuristic, assuming what we see every day and is familiar must be important, enduring and uppermost in the future.

Any swift transition away from today’s system should therefore not be seen as extraordinary, but rather just a further shift in our ability to understand and harness energy, in a journey we have barely begun.

The current era may be better viewed, therefore, as the beginning of the multi-century modern energy system we eventually create.

On top of this many energy forecasts, even those with their references to scientific assessments from the latest Intergovernmental Panel on Climate Change (IPCC) report, rely heavily on geo-political and conservative technology-development foundations, rather than more granular economic and more forward-looking technological assessments.

The IPCC report itself rests on some pretty morbid assumptions regarding fossil fuel dependence: in all its main scenarios (Shared Socioeconomic Pathways – SSPs 1-5), even ones predisposed to new technologies, it sees our future use of coal per capita increasing by 2100, even though aggregate world coal consumption peaked in 2013 – (relying on a so-called “return to coal” hypothesis).

Most current evaluations overlook the massive revolution in new, proven, industrial-scale carbon-free technologies amassing across many economies, preferring to lock horns in ideological battles regarding carbon capture or nuclear, or engage in well-meaning, but sapping carbon tax debates.

So even as sages warn us only to ever expect incremental energy change, or political analysts lament a world that does not understand its peril, the global energy outlook may be far more positive, and poised for change than supposed.

But make no mistake: the reason this post promotes existing advances is so we can quickly eliminate the threats of CO2 warming and pollution; not underplay them.

Its rationale is to help ensure we leverage the technologies that work right now, and not get distracted into reaching for longer-term solutions that are unproven and perhaps ultimately unworkable.

Already we may be in a world of feedback loops that could make current climate disruptions far, far worse.

We have no need to take more of this risk – we can eliminate it by accelerating the deployment of the new energy solutions developed already.

So, in this post we will side less with the gradualists and geo-political elders and side more with the optimists and poets: World is suddener than we fancy it.

Let’s Do the Math

To counter the energy orthodoxy we are not going use an alternative narrative or substitute model projections, or even propose grand new policy ideas about the energy future.

We are going to start from today’s energy reality and use something more fundamental and enduring, infinite even: mathematical equations.

When the present system, and the emerging one are contrasted using these equations, their structures look utterly distinct, the transition, and its speed unmistakable.

Combined, the equations show how the incumbent centralized thermal system has entered a period of slow linear growth, heading towards decline.

And since it is a single-sized, non-learning system, there is no chance of it transforming itself to deal with a fast-moving new competitor: its static nature is perhaps its greatest weakness.

In contrast, the new, developing energy system is growing exponentially, and as it is scalable, based on manufacturing techniques, it exhibits high levels of learning.

Its growth and diffusion rates are therefore rapid, and accelerating.

These features of the new energy system apply to wind, solar, EVs, large-scale batteries and transmission technologies, which we conventionally take these to mean “alternative” or “renewable” energy.

But if we take the long view these growing, learning technologies are more likely to be only the first generation of the new energy systems ahead.

They are showing the way to the energy systems of the next century in the same way the incumbent fossil-fuels emphasise our thermal past.

Deployed quickly enough, the new energies will offer a more efficient, innovative global system, shrink energy costs and start to turn the planetary CO2 emissions curve downwards.

As we’ll see, several regions and countries are already doing so to major effect.

The use of equations is not, therefore, a narrative gimmick.

It is used to show how solid and real the new energy system’s underpinnings are, and how we can leverage it – locally, regionally, nationally and globally, right now – to transform the world energy system.

As the chart below shows, rather than assume endlessly extended oil and gas beyond their R/P ratios, or a return to coal, the energy system of the rest of this century and for the next is much more likely to be that of manufactured energy (1.0 if you like) – wind, solar, batteries, and then version 2.0 which will follow via rapid innovations.

Overview of Energy Demand/ Supply – 1850-2200 (see here for original concept)

Some residual fossil fuel requirements for niche areas such as heavy vehicles or petrochemicals may remain as shown: but the majority of the long-term energy system will be powered by manufactured energies.

The rest of this post is about how this transformation is feasible – so let’s focus on the four key aspects of the energy transition ahead:

Growth, Diffusion, Learning and Transformation

Note – In each of the sections we have shown the maths equation under discussion, and a simple graphic showing the key distinction between the incumbent fossil fuel system (black circles) and new energy system (white circles) – there is also a summary at the end.

The graphics are not meant to be decimal-point correct, but they are meant to indicate relative change.

Let’s start with the first horseman of the energy transition: Growth.

1 – Growth: Linear vs Exponential

When we look again at the charts of population and energy growth we are tempted to say they show exponential growth, meaning constant annual percentage growth rates.

But since the 1960s-70s both energy and population annual growth rates have been steadily declining to under 2% pa now and heading lower.

Here is the chart of global energy annual percentage growth rate from 1966 to 2017, courtesy of BP.

Global Primary Energy Demand % Annual Growth 1966-2017, mtoe

If energy were growing at an exponential rate, the annual percentage growth line would be horizontal – a constant annual growth rate.

But it’s not – it’s a downward line, trending toward zero percentage growth (a peak) from over 4% pa in 1965.

When growth is showing a deteriorating percentage each year it has stopped being exponential, and started to become simply linear – ie a fixed amount of growth each year.

And this trajectory is typically a prelude to an absolute decline in annual growth – shrinking percentages often shrink further.

For example, oil consumption growth over the past ten years has been just over a million barrels per day (the a in the linear equation above).

This sounds good news in oil and gas journals – but it is in fact clear evidence of a system headed toward its maxima.

This is a feature of every one of the “exponential” curves in the triptych above – none of them are exponential any more, they are all exhibiting simple linear growth, headed toward a peak level.

In the case of primary energy declining linear growth is actually a composite of real energy demand decline in developed economies, counterbalanced by growth in emerging ones – read China and India.

But a more coordinated decline is now starting to occur as energy use decouples from growth in those twin giants too.

Hence, peak world population and peak global energy are both within mainstream near-term projections – and peak carbon emissions most likely have already occurred.

Exponential Growth is Growth in the Exponent

At the same time, the new energy technologies of wind, solar and EVs have emerged on a global scale.

From a negligible base pre 2010, these technologies have exhibited sustained and substantial rates of growth over time: 15-20% pa in the case of wind and solar and greater than 50% in the case of EVs: in other words, exponential growth.

In an exponential equation even if a is initially a low value, at rates of 20% growth pa it is increasing at 1.2 times each year.

The shortest way to express this mathematically is to set the yearly growth as an “exponent”, x, the number of years – hence the equation above.

The exponential is a fearsome growth equation: in the case above it grows 20% every year, no matter how big the underlying numbers get, (in contrast with linear growth’s fixed size).

This rate of exponential growth works out as more than a six-fold expansion every 10 years.

Back in the real world, wind and solar are approaching 10% of global power generation in 2018, from about 1.5% ten years ago – a six-fold increase due to their 20% growth rates.

In mathematics there is a simple rule: over time exponential always wins – no matter how small the initial value, geometric growth defeats linear.

Too often in long-established industries, there is an assumption that low-level but exponential demand growth is still achievable; 2-3% pa demand growth for example is often used as a business model heuristic for 5 year forecasts.

But in mature industries such low-level exponential growth would be remarkable: much more likely, and in reality as we have just shown, growth is declining, signalling its demise toward a peak via linear growth.

All of this is to say is that as the new energy system grows exponentially and encounters the linear and declining incumbent one, the two will start to compete very quickly and very aggressively, which is what we are seeing across various energy-based industries from cars to gas turbines and coal plants.

The erstwhile industrial titan GE ignored this basic piece of mathematical reality in its forecast for gas turbine demand in 2017, with severe consequences that still play out.

And the BP Chart below shows the various exponential and linear collisions ahead.

In opposition to the ideas of slow, orderly transitions, exponential rates colliding with declining linear ones suggest that peak fossil fuel demand could happen within the next couple of years, and certainly in the early 2020s.

This leads to another important question: even though the new energy system is growing quickly, could it be that it only ends up as a large niche, much like nuclear and hydro, or will can largely replace the incumbent fossil fuels for the long-term?

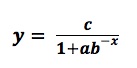

2. Diffusion: The S Curve

Most (successful) new technology adoptions follow S curves, formally logistic curves: these curves neatly describe how the uptake of technologies grow exponentially at first before reaching an inflection point as demand starts to deplete, then slow toward linear growth, plateau and finally decline as market consumption is sated.

So, the S curve above will be familiar, but the equation may not be.

The normal mathematical form of the logistic curve has been discussed before, here.

One way to quickly figure out the formula is to recognize that it is just an exponential equation that is constrained by the capacity number, c.

Esoteric or not, you would be amazed how many daily phenomena follow this mathematical plot.

The figure c represents real-life limits, for example the carrying capacity of a country’s population, or the market share for technologies such as TV sets or cars.

Fossil fuels have been successful technologies, and have followed the S curve pattern (whereas less successful ones – nuclear, biofuels, hydropower – have leveled out at niche levels).

We could summarise the first section on linear and exponential growth using a logistic curve: the new energy system is on the steep upward slope of the early growth phase, whilst the incumbent system is on the near-zero growth high plateau moving into decline (both in terms of global power market share and ICE vehicle market share) – see graphic.

The question we posed was: is the new energy system growth sustainable enough to displace the current one, or will it too level out to become just another energy niche?

Before we offer an answer, let’s reflect more on what the logistic curve is telling us.

Critical Mass

Another way to derive logistic curves is via cumulative probability: if you draw out a normal distribution curve – a bell curve – and plot the aggregate probability up to 100% you (more or less) generate a logistic curve.

Everett Rogers made an ingenuous association using this fact in his classic work the Diffusion of Innovations: he took the cumulative normal distribution of probability (an S curve) and labeled the various segments of the curve (the standard deviations in mathematical terms) into categories of human behavior.

His theory of technology diffusion was based on looking deep into why early adopters behaved as they did, using threshold and network analyses, and he arrived at mathematics that followed the normal distribution curve

People in the vanguard of technology adoption were labeled Innovators, followed by Early Adopters, then Early Majority, Late Majority, and finally Laggards.

And by using that curve he could put quite precise predictive percentages on each category of technology adopter – innovators being the first 2.5% of demand growth, early adopters the next 13.5% for example.

The upshot was that if a technology managed to (quickly) breach a level of 5-10% adoption in market demand, that tended to be the critical mass of wider adoption.

At this point the technologies were successful enough (in price, value, performance etc) to satisfy the needs of the innovator and early adopter segments, which became fully stacked.

In turn these powerful groups started influencing the rest via example, knowledge-transfer, experiential diffusion, and by providing suppliers with enough core demand to generate lower costs, and hire more resources.

The insurgent technology would then push on to take a large majority of the market: new technology industrial and social networks overwhelmed incumbent networks and so on.

Since 2010 wind, solar and EVs have been showing this type of rapid market adoption in many key markets such as China, California and the EU.

Wind and solar command over 9% of global power generation for example, growing at 15-20% pa. Nuclear and hydropower never attained these rates of growth or adoption outside a few specialist countries.

And EVs now supply over 5% of Chinese passenger car sales, and 8% of Californian car sales, with growth rates of more than 50% pa.

Even in the semi-reluctant US market for EVs, the presence of early-adopter Tesla owners appears to have catalysed exponential diffusion of buying behaviour toward the sector, even as the overall US market for car sales is down:

source: insideevs.com

This rapid global diffusion in new energy technologies is likely driven by two major factors.

The first is increasingly obvious: the new systems provide more economic and environmentally sustainable technology.

The second factor is less obvious, and leads to another powerful equation.

First, costs and carbon.

We have covered this elsewhere in detail: but the upshot is that wind, solar and EVs have grown quickly and substituted the majority of energy growth at the margin because their costs are now level with incumbent alternatives – and headed lower.

In the case of wind and solar, are competitive not just with new-build thermal plant, but with the operating cost of existing ones.

It is worth pausing here to ponder that simple sentence.

After only ten years since reaching industrial scale, wind and solar are now able to compete with thermal technologies that are over a hundred years old on the basis of – not like-for-like build – but pure operating cost (allowing the fossil plants to ignore their large historic sunk costs).

(For any commentator still holding out for Hail-Mary technological feats, or magical breakthroughs in carbon capture – please reflect. Sit down and look at the remarkable achievements of prosaic, grinding, growing and improving wind, solar and batteries, and recall the formidable power of exponential curves).

Add to the economics the beneficial environmental impact of zero carbon emissions, and the low risk investment case of wind/solar technologies, and their attractiveness now as the first choice for power companies and other buyers becomes clear – especially those with limited indigenous oil and gas such as China and India.

Their rise has already forced the cancellation of several hundred coal-mines in China and India, and accelerated the disappearance of coal from the UK and Spain and US states such as Colorado and North Carolina. Similar impacts on gas and nuclear power plants are also being seen.

The second reason that the new technologies are diffusing so quickly is that the incumbents cannot react: they are standing still.

The relative speed of diffusion is therefore unchecked, except by policy and regulatory action (and often not even that is effective).

Normally when a new entrant steals rapid market share the incumbent can fight back for a time by reducing costs, or quickly developing new products, or reinventing its core offer (“sailing ship effect”).

The fossil fuel (and nuclear) industries however have little alternative to offer but the current energy system over and over again.

The technologies of oil, gas and coal extraction, transportation, refinement and combustion have become modestly more efficient over time.

But bound by the laws of thermodynamics, and the limited improvements available to complex mega-scale construction projects, the fossil fuel system is vastly inferior to the new one in another important mathematical way:

It cannot learn, whilst the new system can.

This is why the answer offered here to the replacement or co-existence question is – the new energy system is far more likely to displace the thermal one, than co-exist as niche.

Because not only does it already compete on cost – it is also still learning.

3. Learning– Trial and Error versus Error

![]()

Moore’s Law, Wright’s Law, Swanson’s Law, Flyvbjerg’s Law.

The first three laws in this series may are relatively well known in manufacturing and industrial analysis.

They are laws in the sense of well-documented recurring examples of the phenomena of cost reduction or efficiency improvement over time in manufacturing environments.

In such conditions, repetition of task, trial and error, leaning and thus incremental advances all add up to a constant improvement in task time, or unit cost, leading to the regular upgrades and cost reductions we recognize in consumer products such as PCs, and flat-screen TVs.

Moore’s Law notes that computer transistors per unit area (or processing power) double every 18 months or so.

Wright’s Law more generally develops the concept of the learning or experience curve, for example costs reducing by 20% every time cumulative production doubles, and Swanson’s observation applies that very learning rate to PV solar panels.

These laws of manufacturing are well studied and have been shown to go beyond empirical observation, and track a power law equation.

This equation is often assumed to be much like an exponential, but there is a crucial difference: exponential growth has a constant base number and a growing exponent – power equations are the reverse, changing base, constant exponent.

When the exponent is less than zero it describes actual experienced learning curves: curves that drop in value quickly from the first unit to the next, and then flatten out over time as the benefits from learning are less pronounced, the big improvements less obvious to find.

Thus as x or cumulative production grows, the y value or costs per unit decrease and the exponent b is the learning rate.

In the example of PV solar panels, the b value is -0.33, and it describes a 20% learning rate, with unit costs 80% of the previous value every time cumulative production doubles.

EV batteries and power-train costs show very similar behaviour and cost reductions, which is why both are becoming mainstream technologies at pace.

By some estimates EVs will compete on price and feature parity with ICE vehicles by 2019 onwards for luxury models and 2022 for mass market.

Whatever the actual date, the key point is that after that point the learning rate of EVs will continue, and so the gap with ICE vehicle costs will widen year by year.

ICE learning improvements are likely to plateau or even reverse as marginal investment levels decline – another example of the thermal energy’s relative stasis compared with manufactured systems.

In the case of solar PVs, costs have dropped by 80% in the past 10 years as cumulative volumes have doubled over 6 times – and like Moore’s transistors, this learning rate seems to be continuing (and indeed increasing by some estimates).

This mathematical precision has profound real-world consequences for energy.

The simple equation, precisely defining the phenomena by which repetitively manufactured technologies decrease in cost consistently over time, explains why solar and wind power technologies have moved from a few dozen GW of installed capacity to over 1000GW globally within a decade.

And why the costs of doing this have dropped below that even of already installed thermal power plants

Levelled Cost of Electricity, LCOE Lazard Analysis v11.0

Given this velocity of learning, playing catch up with the thermal system will only be the start: we’ll soon see energy costs drop below current thermal levels, and continue to improve.

This is of course due to the new energy system’s learning rates: but it is also due to the fact that the existing energy system can only stand still; it has no further learning power left.

For fossil fuel extraction and production, learning rates follow the last of the laws above – Flyvbjerg’s Law, the law of megaprojects: Over time, over budget, over and over again.

In fact Flyvbjerg has far more precise data on over 200 global mega-projects, many in oil and gas.

His work shows that over 90% of oil and gas extraction megaprojects are 25-35% over budget and schedule, with 20% runaways ending up with over 100% cost and/or schedule increases.

Allied to the declining size of oil and gas field to exploit, the learning rate for oil and gas extraction is close to zero, and in the case of nuclear actually greater than zero; costs are increasing over time (see chart above).

Some of this is argued to be due to regulations and declining reservoir size.

But the largest factor is that fossil fuel production is not a manufacturing process, it is a complex customised extraction and engineering activity, leading to the start of the learning curve every time.

There is no experience curve because there is no general, transferable experience: each mega-project is its own subjective, isolated occurrence.

So much so that oil and gas project costs do not follow the normal distribution curve we discussed earlier – they follow fat-tailed gamma distributions making them hard to estimate and frequently prone to massive cost over-runs.

In sum they have no ability to trial and err; only err, occasionally catastrophically.

On top of the project complexity factors, lack of scalability stymies physical innovation: no new micro-reactors or mini-refineries of any significance have been developed.

And the fossil fuels themselves: methane, the higher alkanes, and the various coals – are fixed in their chemistries; their energy density and efficiencies, their emissions intensities and their handle-ability are all set – gasoline can only convert a maximum of 30% of its energy to power, and as a volatile liquid it still has to be delivered to vehicles via the same methods conceived in the 1920s.

US shale production has brought manufacturing techniques to extraction: but even with high growth they represent only 7-8% of global output, and suffer from the same fate of all extracted fuels: reservoir decline curves gnawing away at any marginal learning curve benefits.

And any innovation in fuel energy usage has largely been driven by those who consume it: sectors such as utilities, airlines and shipping who regularly redesign engine technologies, and automotive companies, who have to bow to consumer pressure and government policies.

The fossil fuel extraction system is thus structurally unable to innovate further: the limits of its scale and its fossil-fuel chemistries confine it to its current form indefinitely.

Large oil and gas companies are able to make profits from this frozen system due to controlled markets for their products, and from almost no competition for the past 100 years.

The nominal cost of oil therefore remains high; today’s value of $70/bbl is well above the inflation-adjusted level of about $40/bbl, a price that most international oil companies suggest would put them out of business.

All this forces a major conclusion: if oil and gas companies had to build a new fossil fuel system 50 years from now, from scratch, it would be more or less the one you see today, and likely at the same cost (plus inflation).

That said, this analysis flies in the face of the IPCC assessments which expects “Learning by Extraction (LBE)” methods to occur over the coming decades. allowing, as we’ve noted, a renaissance of and century-long dependence on coal.

Others disagree – the evidence is not there – and we concur, and point to the vast increases in industry capital expenditures for limited production gains over the past few decades as evidence.

Flyvbjerg’s non-learning Law has held for over 50 years – and it is almost certain it will continue for another century.

The two energy systems could therefore not be more different when we look at their learning capacities.

And although it is often assumed that the reducing cost of wind, solar and battery technologies has been their greatest advantage, it is their learning rate and scalability, hence innovation, that is more likely to sustain and then accelerate their future growth across the global energy system.

The new system is not just competing like for like with fossil fuels for energy applications in power, heat and transport, they are starting to develop new energy options such as micro-grids, customized energy billing, and multi-location car charging that the current centralized fossil-fuel energy system is incapable of ever providing.

This then leads to a compounding effect: the low-risk nature of these investments facilitates experimentation with small-scale manufactured energy technologies: individual entrepreneurs or mid-size investors, as well as the larger players, can now stake capital directly in energy development.

And communities and individual companies can customize their energy requirements as well – such is the nature of scalable, manufactured energy.

We need to free ourselves from the standard notion that energy development is only for big nation-state or international corporate-sized entities: that era is receding, and receding quickly to be replaced by one of innovative, global, and multi-scale energy developments.

Moore’s Law has continued for over 30 years so far: there is no reason to see why Swanson’s learning Law cannot do the same.

Just the Beginning

This is certainly all positive for new energy deployment with it’s rapid scalability and universal applicability – but now its potential has arrived, it is being asked to rise early in its life to perhaps the biggest challenge it may ever face.

Can the new energy system advance fast enough in the early 2020s to stop the risks of rapid climate disruption wrought by the previous system over the past 150 years?

To try to answer that we will revert here to a curve that you may have (deliberately) forgotten from your schooldays – the quadratic equation.

4 – Transformation: The Turning of the Curve

![]()

Like evaluating blood pressure in a patient, we will objectively know if we have managed to transform our energy system by measuring the amount of CO2 still being pulsed into the atmosphere decades from now: if levels are far lower, we have changed it, if not we have convinced ourselves that some other priority was greater.

Fossil fuels (hydrocarbons) are burned in the presence of oxygen in industrial applications, such as cars and power stations, to form mechanical or electric energies via gaseous expansion, and in so doing they emit carbon dioxide and water as by-products.

There is an equation for that too (a chemical one) – here is the oxidation of natural gas (mainly methane, CH4) to form carbon dioxide and water. Every other fossil fuel follows the same general equation.

![]()

Since the industrial era began in 1850, and expanded globally via fossil fuels, this equation shows how CO2 has clung to progress like a shadow.

About 50% of all the CO2 ever formed via the equation above has remained in the earth’s atmosphere; as industry grew exponentially, so did atmospheric CO2 concentration.

We now emit about 37 billion metric tonnes of CO2 every year, and the atmospheric global CO2 intensity has risen from about 280ppm (parts per million) in 1850, to 410ppm today, an average of 1ppm increase per year, with a slow start, and now at an increased rate of about 2-3ppm per year.

This embedded CO2 absorbs solar light reflected from the earth’s surface trapping it as heat energy in the atmosphere – the greenhouse effect. As CO2 levels increase they therefore raise net global temperatures, in a strong linear relationship with overall CO2 concentration.

This has caused global temperature to rise by 1°C since 1850, with about two-thirds of the increase happening in the last 40 years.

Expectations are that we will reach 1.5°C above 1850 levels by 2040 or so unless our use of fossil fuels, and hence CO2 emissions, change significantly.

Atmospheric CO2’s impact on surface temperatures and the possible consequences for planetary life are documented fully in the latest IPCC special report.

Whilst we’ve challenged some of the long-term assumptions in that report, eg coal dependence, the near-term temperature rise analysis and impact is much more certain.

We will not explore those consequences further, save to say they look grim, and grim soon, for many species, especially our own, which is highly adapted to increasingly fragile environmental niches such as coastal locations.

What we will look at is the shape of that CO2 emissions curve.

Quadratic Equations

As we saw for population and energy demand, CO2 emissions have stopped growing exponentially, and in the last few decades their trend has moved to linear; in fact in the last couple of years growth has stalled completely.

This has lead to the concept of the Environmental Kuznets Curve (EKC), applied to global CO2 emissions.

This theory posits the idea that we may be entering an era where the negative aspects of energy technology (CO2 emissions) have peaked, and are being increasingly reversed by energy efficiency and latterly the emergence of the new, cleaner energy technologies.

Let’s back up a bit though – what is a Kuznets Curve?

Introduced in the 1950s by economist Simon Kuznets (who later won a Nobel Prize), it proposed that seemingly positive developments such as increasing population affluence measured as increases in GDP per capita, were often accompanied (initially) by more negative consequences such as wealth inequality.

Eventually wealth dispersed more generally to counteract this, and the inequality dropped backwards. Plotting GDP growth against wealth inequality traced an inverted U-shape curve (or parabola for fans of quadratic equations).

More recently analysts picked up on this general idea by looking at how other aspects of modernization such as fossil-fuel technologies often brought negative externalities eg air pollution (think London and Beijing smogs), before these were eventually moderated.

The notion of the Environmental Kuznet’s Curve (EKC) was conceived.

Plotting CO2 emissions against GDP/capita growth in various countries or at the global level shows that emissions grow as industrial development progresses. No surprises there.

The critical issue though is two-fold: first, is there a counter-balancing force that eventually overcomes the negative side-effects of fossil fuels, as Kuznets predicted?

And second, if there is, can it act fast enough to prevent global temperatures rising above the 1.5°C IPCC threshold over the next 10-15 years?

The answer to the first question is almost certainly yes: there is a countervailing force starting to slow down the atmospheric juggernaut of CO2 emissions.

Emissions have peaked in the past 2-3 years in line with the EKC idea: the growth relationship of carbon emissions with industrial fossil-fuel development seems to be faltering.

This makes sense: energy use per capita in developed nations has already started to decline via energy efficiency gains, and the decline in coal use – by far the most intense provider of carbon to the atmosphere – has been sharpest in major consumers such as the US and China.

The example of the US power sector below (note the shape of the CO2 emissions curve) reveals the impact of these combined shifts: greater energy efficiency, the switch from coal, and the rise of new clean energy sources. The result – a near 30% reduction in CO2 emissions in the space of 12 years, the sort of pace required in the IPCC analysis.

This point is worth pausing on. Only a few years ago CO2 emissions were feared to be growing exponentially: today they have likely peaked.

China’s pivot to non-coal energy growth has been swift and massive.

This is because it is governed by self-interest: avoidance of increasing nation-wide health risks, and the sudden opportunity to take a leadership role in 21st century manufactured energy.

And with limited natural resources, China would be looking otherwise at a century of fossil fuel import dependence (from the US, Russia, Saudi Arabia, Iran and Iraq ….) were it not for the alternative energies that have now arrived on its factory doorsteps.

Abruptly yanking vast amounts of coal-based energy out of the world-wide energy equation has kick-started that bend in the global carbon curve.

Other nations such as India are now following this example adopting the self-same technologies.

There is still much, much to do, but let’s not gloss over this massive switch by China: at once rapidly reducing future coal consumption, whilst driving the development of low-cost new, globally accessible, energy technologies.

For all the lamentations about China’s reliance on coal-power generation, the numbers support the view that their policy moves are having a noticeable impact. China’s absolute coal use peaked in 2013, and its emissions growth at 1.6% in 2017 was 50% below the average level of the prior decade.

Yet – can the downturn be fast enough to reach the IPCC goals?

Initial reactions seem to be that it is unlikely, because for example it would need a “six-to-fourteen-fold” increase in solar / wind / battery technologies by 2030-35 to reduce global emissions by half.

Some pessimism is understandable: we almost certainly only have wind, solar and batteries to rely on.

All the other carbon-reducing options such as land-use change, geo-engineering, carbon-capture and storage, nuclear and behavioral or policy shifts such as carbon taxation all fall way short for two main reasons: they are technically unproven and very expensive or too slow and marginal in impact over the 12-15 year time period.

But still – we need also to avoid falling for another Malthusian trap.

Remember we noted the colossal power of exponential growth against all other forms of mathematical advance.

Note again the equation of the inverted U-shaped quadratic equation: bx-ax²

The a term can be looked on as efficiency gains, or alternative technologies such as wind / solar, replacing fossil fuels (see the US chart above).

If a starts to grow quickly, the x² term will dominate, and bend the Kuznets curve sharply downwards.

The analysis of EKC is still being developed, and it’s difficult to know exactly what will influence the a term and to what extent.

But it seems reasonable to assume that the faster the growth of wind/solar and battery technologies, the quicker that term will grow.

We noted that the exponential growth rate of 20% pa allowed a six-fold increase in wind/solar deployment over the last ten years.

Let’s assume we have 15 years reach the six-fold minimum increase of today’s almost 1100GW of wind/solar to bend the carbon curve substantially enough to avoid the 1.5°C breach.

That implies an exponential growth rate of 12.5%, and would move wind/solar to over 50% of global power generation by 2030-35. Global car fleet fuel emission rates could also be over 30% lower at that time too with EV growth rates of a similar size.

So the reduction in emissions is possible given current new energy growth rates.

Sustaining 12.5% for over a decade will not be easy. That said, wind, solar and battery technology efficiency is improving (learning), so the growth in deployment rates required to meet energy demands may not be as onerous we expect right now.

All this is to say, is that now that the new energies have grown to world-class scale their continued growth provides the real possibility of driving carbon emissions downward fast enough to preserve global warming limits.

Of course we should not rely passively on a coefficient in a quadratic formula to be the solution to our global carbon emissions problems – an unlikely superhero if ever there was one.

But we equally should not depend on current forms of magical thinking; no need for technology X, no need for grand-scale geo-engineering and carbon sequestration, no need for exhausting negotiations over carbon tax options and mechanisms.

All these can help, but they are those same counsels of despair sprinkled with faux-optimism, when we have the proper solutions, in the form of fast-growing, economic, learning, scalable world-scale technologies, to hand.

Let’s not get distracted in complex battles over technologies that don’t exist and policies that have been constantly played and delayed.

Let’s instead just do the math with the solutions working, growing and learning right now.

And recognise there is a transformation, driven by the numbers, already underway.

From Maths to Scenarios and Straight to Policies

We have analysed two distinct forms of world energy system: the dominant extractive fossil-fuel based one, and its antithesis, the fast-growing manufactured conversion-based alternative.

In doing so we have created two quite distinct scenarios: not by generating “internally-coherent geo-political narratives”, but by describing each one in terms of mathematical equations.

Here is what that analysis shows in summary form: the equations, the curves and the real-world examples around us.

Fossil Fuels: Incumbent, Finite, Slowing, Declining, Non-learning and CO2-Emitting

New energy: Established, Infinite, Growing, Diffusing, Learning and Emission-free

source: dollarsperbbl analysis

This might seem abstract and idealistic; we propose it is the opposite; it leads to concrete, practical policies immediately, because the numbers support scrutiny.

The actual on-the-ground, cost-effective, working evidence of wind, solar, battery storage and EVs is already world-scale, proven and economically sustainable.

The incumbent fossil-fuel competition is increasingly rendered uneconomic as it cannot change to contend.

Whilst this causes creative destruction, and hence political and policy complications, many areas are already adapting by reading the economic landscape, and recognizing the new energy system creates many new jobs and options to compensate.

Countries and large regions as diverse as Spain, the UK and South Australia, California, Colorado and North Carolina have proactively shifted from fossil-fuel systems to new energies, and used these mathematical facts and innovations to smooth the transitions.

Policy innovations are more effective in these situations when there is economic and technological advantages to point to: lower energy costs and increased net employment allow the opportunity to fund early retirement, re-training in new technologies, and tax rebates for the populations affected.

All these practical energy transformation developments are possible with a new competitive system that fully exists and is growing fast, rather than attempting them, ab initio, via speculative technologies and fiscal policies that are often resisted by regulators and incumbents.

We may have yet again skirted a Malthusian Trap via our ingenuity and focus on mathematical foundations.

It’s critical we don’t get distracted when we have the solution at hand.

Because this is just the beginning – we have centuries yet to go: and across all that time the need to provide sustainable energy for 10 billion souls.

————- ![]() ————-

————-