Decarbonising Capitalism: In 2019 Post-Carbon Energy Gets Underway

“In the long run, decarbonisation could be a way of reinvigorating capitalism.

Mass electrification, from zero-carbon sources, could stimulate new industries and further decentralise the global economy.

It could absorb some of the surplus savings that exist in parts of the rich world, provide plentiful demand for jobs to meet the engineering challenges and ease energy poverty in poor countries.

It might sound far-fetched in an era of trade wars and isolationism to think that anything can be done for the common good.

But using human ingenuity to build a post-carbon future could be a big economic, as well as environmental, opportunity.

Sadly, mankind is still not doing nearly enough to rise to the challenge.”

“All is quiet on New Year’s Day

A world in white gets underway”

No Predictions – Just Extrapolations

We will make no predictions for 2019: the simple extrapolation of two trends will dominate the energy world over the next 12 months, and beyond.

Despite understandable pessimism, the Economist quote above is instinctively wrong in its conclusion: mankind, in fact, has been doing enough to rise to the challenge of the post-carbon energy transition.

Perhaps, so far it has not been immediately obvious.

But two underlying energy trends are now about to create a sudden shift in perception: the complete dominance of marginal growth by wind, solar and batteries in power and transport, and the rapid implementation of the decentralisation of the energy system.

2019 is the year in which these trends – suddenly – become substantial and widely noticeable.

Marking the entry of energy into the post-carbon era, and the start of decarbonising capitalism.

Marginal Change Gets Real: Wind, Solar and EVs Completely Dominate Energy Growth

In 2019 wind and solar will provide over 70% of global power capacity growth, and EVs 100% of light vehicle sales growth.

Marginal change can be a dry subject, leaning hard on maths derivatives, causing eyes to roll two sentences in (about now).

We have used Hemingway quotes, nice diagrams of S curves, and even the nuclear option of resorting to quadratic equations.

But in 2019 we will be able to appeal more to Bad Boys II: this shit just got real.

There are too many tipping points ahead next year for the world at large not to notice an energy shift.

Take global power generation.

One of the energy world’s most secure extrapolations is that PV solar and wind turbine costs will continue to drop as manufacturing techniques advance, and with China at the helm of installation.

Wind and solar deployment will continue to grow at 15% pa and costs – already at parity with thermal fuel equivalents – will fall by a further 20%: so, by end 2019 1,300 GW cumulative wind and solar power-generating capacity will have been installed world-wide, with almost 200GW added in the year.

To give perspective: world-wide installed power capacity is about 7,000 GW: thus gross wind / solar capacity will be just under 20% of the world total by end 2019, and the 200GW addition will provide over 70% of marginal annual growth.

(Note (1): we confine the issue of capacity factors to footnotes, which is where energy history will too.)

The impact of marginal change in global transport in 2019 will be even more significant.

With Tesla as poster child, and China as propulsive force, EVs will start to become – “suddenly” – ubiquitous.

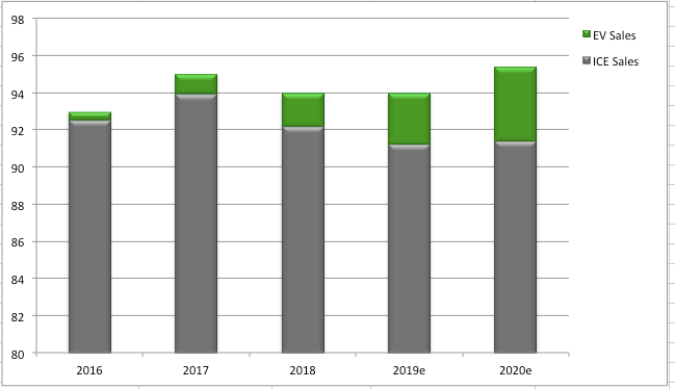

2017 was the peak of global internal combustion engine (ICE) vehicle sales.

In 2018 global car sales growth fell for the first time in 15 years, even as EV sales grew by over 60%: in absolute terms traditional ICE sales fell by 2m units, whilst EV sales grew by almost 2m units (see charts).

Simple arithmetic means that conventional ICE vehicle sales have now reached a peak they can never re-attain – EV annual growth, 3m units in 2019 and growing at 60% pa, will remove any ability of ICE sales to get back to the high of 94m units in 2017.

Annual light vehicle car sales, global – source LMC

Actual Forecast ICE and EV vehicle sales 2016-2020e: source LMC and dollarsperbbl analysis

From 2019 onward, EVs will generate all worldwide auto market marginal growth: a phenomenon that will be difficult to miss, as advertising and dealerships react to the abrupt technological pivot.

VW, GM, BMW and other OEMs will release a range of E-models, as will new, interesting brands such as Nio, Kandi and Lifan from China.

These models will be suddenly be available, and in key markets – California, China, the UK and Germany – where market shares of plug-in cars will breach the 5-10% sales barrier.

EV brands in the top ten car sales data will become a thing.

2019 therefore marks the year in which the relentless marginal growth trends in world energy enter the spotlight: wind and solar dominating power capacity growth, and EVs forcing the historic peak of conventional vehicles sales.

Creative Destruction: Centralised Energy Becomes Dispersed and Distributed

2019 will also see a fundamental shift along the maturity spectrum of the energy transition: the mass implementation of decentralised energy.

Wind, solar and batteries long ago left the laboratory, with solar cell and wind turbine science completed, and engineering now in the enhancement phase.

What is left is implementation – the wide-spread distribution and placement of the manufactured energies.

Schumpeter would have labelled it the moment of creative destruction of the existing energy system.

Put another way, this is us entering the steep part of the technology S curve: which is, as the Economist instinctively guesses, likely to be a highly innovative era of new energy systems.

The traditional energy model is one-sized: the big power plant running a centralised grid managed by state-backed utilities, or transport fuelled by a few big refineries supplying mid-sized filling stations.

The new model of energy is nothing like this.

In power, wind, solar and battery technology is scalable (able to be manufactured and assembled in various sizes) – it produces mass-scale energy via the giant sum of many smaller and simple-to-make energy units.

And in transport, the switch to electric power from liquid fuels marks a fundamental pivot in terms of flexible energy access and innovative energy services.

The dispersed nature of the new technology is also making energy far more democratic, and less isolated, both physically and socially.

Any country, region, state, town, corporation, community or household in the world with the money and policy drive can start to supply local power needs via the purchase of the requisite number of turbines, solar panels or car-charging equipment, either directly or via entrepreneurial distributors.

It will start to make energy more people-intensive again with a focus on the installation of solar and turbine arrays or charging piles and stations, and the addition of value-add services.

In the fossil-fuel era energy services were simply centralised-system adjuncts – perhaps adding a coffee-shop to a filling station: in the post-carbon mass-electric energy era it will be much more personal and consumer-directed, providing apps to implement and oversee house-hold or corporate energy management, or to optimise daily car charging.

All of this is unfolding in real time – and we can take the UK as an example.

The chart below adapted from Carbon Brief shows the shift politically, geographically and most importantly by physical scale and design of the UK power system over the past 50 years (the data takes us only to 2015, but the trends shown have continued).

The UK needs about 80-100GW in power capacity.

There are about 60 thermal plants in the UK providing 50GW gross capacity; but over a million solar installations and 10,000 turbines providing 30GW gross capacity.

By 2023 thermal capacity will fall to below 40 GW, with zero from coal, and 55 GW from solar / wind: coal will have dropped from 40% of UK power in 2013, to 0% in less than 10 years.

All this is the consequence of rapid energy technology growth at the point when overall power demand declines (the impact of marginal growth once again).

Coal is squeezed out first. And the need for any further additions to nuclear and gas are now under question: centralised thermal power withdrawing into decline.

At the same time, and in the same way, EVs and battery storage are transforming UK transportation making it dispersed and decentralised.

In the UK there are 8,000 petrol stations, or about 32,000 petrol pumps for 33 million cars, about one per 1,000 conventional vehicles.

Already there are 19,000 EV connection points for 180,000 plug-in EVs or roughly 1 per 10 EVs – similar ratios to the US and Europe.

This far higher (two-order-of-magnitude) ratio will continue as the diversity of charging points increases: from home, to kerb-side, to car-park, to special bays – and so on.

In 2019, accelerated by the sharp decline in conventional diesel sales, plug-in EVs will probably reach 5% of car sales in the UK, growing by 80,000 or over 30% pa, with another 8,000 connection points added, even as the conventional car market contracts again.

The dispersed nature of transport is now underway – and “suddenly” new charging options and new EV brands will be available to buy for the UK’s streets.

To sum up: energy is decentralising, and decentralising in an increasingly noticeable way.

In 2019 the challenge for the energy transition will not be science, economics, subsidies or performance; only the pace of implementation of now-proven technologies.

Post-Carbon Energy Gets Underway

Where the Economist is instinctively right is in its hope that the decentralisation of energy will produce a different and more effective energy future.

We argue here that that shift is already with us, and we may be far closer to resolving the climate impact of carbon fuels than we tend to think.

Soon, and suddenly – we expect this coming year – zero-carbon technologies will begin to dominate the energy industry, consuming almost all marginal growth in power and transport, and being deployed at mass scale.

If the global wind, solar and battery industries remain focussed on implementation the probability of avoiding high-risk climate shift will also increase substantially.

Of course unforced errors are still possible: car manufacturers could delay switching to EVs, or wind and solar firms postpone investments due to tariffs or other policies, or the industry get distracted by attempts to create new speculative technologies.

And the incumbent industry could stage a more robust defence – although that seems less and less likely.

Rather than reacting to new energy technology via innovation or cost improvements as in most industries under transition (see sailing ship effect), the oil and gas industry seems to have recoiled into an introverted tactic of counter-narratives about how new technologies present no major threat, and opt for a steady reliance on the cartel behaviour of OPEC plus Russia.

For many years, rather than meet post-carbon technologies head on, the incumbent industry has published analytical reviews such as the IEA World Energy Outlook intended to show how incoming energy changes will be slow, smooth and non-disruptive.

As this excellent critique in Quora from Paul Mainwood notes: “This (IEA) undercalling is familiar in legacy, dying industries.Kodak had similar curves drawn every year.”

It is also perhaps an instinctive realisation by the industry of its primary weakness: it cannot adapt, its main business model is all it has.

It can tweak designs here and there, and shave costs with suppliers when necessary. But that is it for a one-sized extractive system. Costs increase over time as reservoirs deplete, and carbon fuels always produce carbon dioxide.

Boxed in by geology, physics and chemistry the incumbent system is hunkering down for the storm ahead in the form of cost-efficient, zero-emission manufactured energy.

The post-carbon industry system has been in the deep development phase for over a decade now, and is ready to suddenly emerge and literally re-shape the energy landscape.

Mass electrification from zero-carbon sources is not a utopian vision: it is a simple extrapolation of current well-defined trends in wind, solar and battery technologies that are leveraging the learning curve effects of manufacturing systems applied to industrial-scale energy.

These technologies have reached a serious and mature phase, and are now capable of creating a scalable, distributed system that will handle the world’s energy needs of this century and beyond.

.

Mark 2019: the year the post-carbon energy system gets underway, decarbonising capitalism.

Happy New Year.

————- ![]() ————-

————-

(1) Note: capacity factors , or actual versus maximum power output, of thermal plants and wind/solar installations are often used to add skepticism to the impact of new technology – fossil fuel plants tend have capacity factors about twice the level of wind/solar. With the price of solar PV and wind turbines at ever decreasing levels, creating levelled costs of electricity below the operating costs of thermal plants, this objection is now outdated. Simply put, as PV and wind-turbine manufacturing operating costs are so low, and the input fuel infinite, building double the amount at very low marginal solves the capacity issue at a stroke – only land constraints remain an issue. It is a footnote issue.